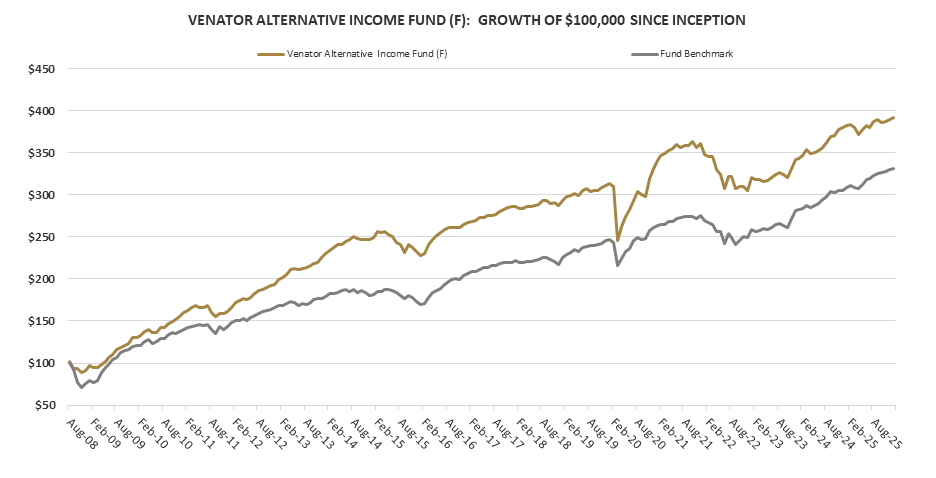

VENATOR ALTERNATIVE INCOME FUND is an actively managed, long-bias North American yield mandate that strives to generate capital growth, over time, with relatively low volatility and an emphasis on capital preservation. The Fund strives to provide improved downside protection and better risk-adjusted returns as compared to traditional fixed income funds.

The underlying strategy is best described as ‘yield plus’, which refers to the objective of finding opportunities that combine attractive yield with the potential for additional return, without taking unnecessary risk(s).

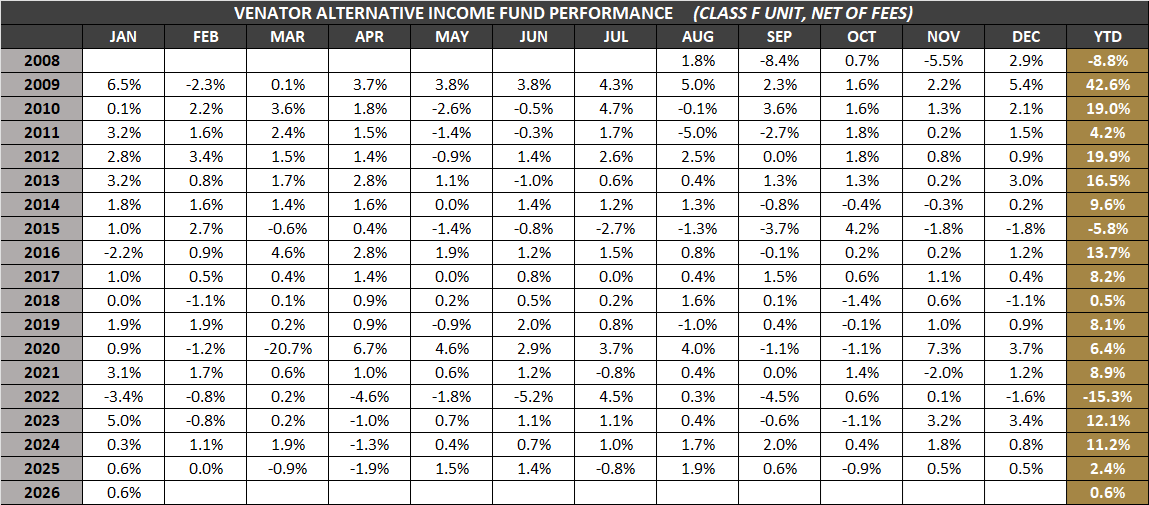

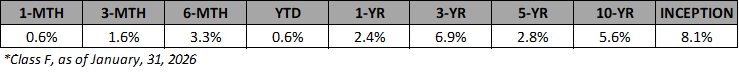

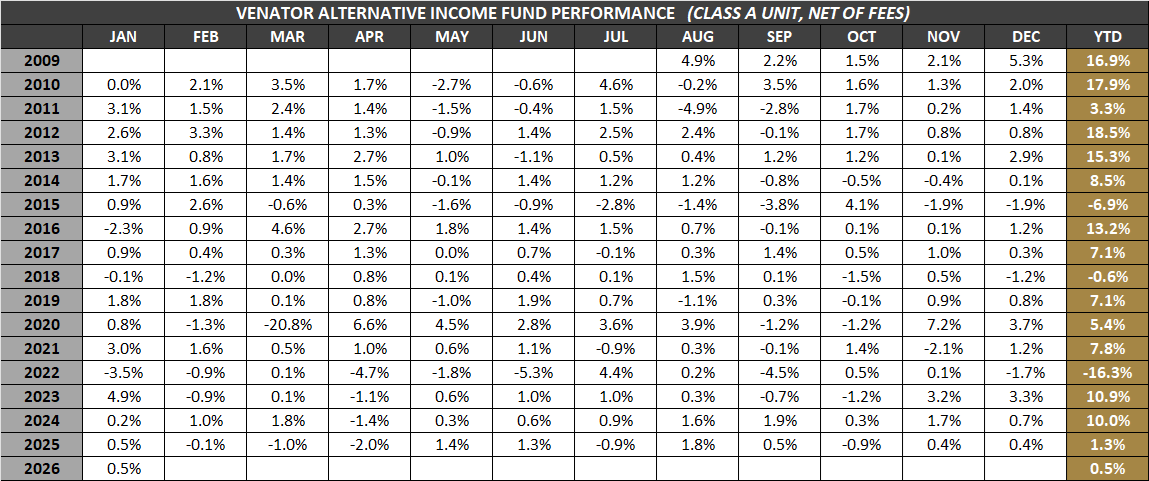

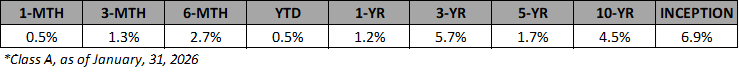

*Performance data prior to January 24, 2020 relates to Class A & F Units of Venator Income Fund, which was distributed to investors on a prospectus-exempt basis in accordance with National Instrument 45-106

**Fund Benchmark = 75% of Merrill Lynch High Yield Index and 25% of the Bloomberg Canadian High Yield Corporate Bond Index

Commissions, trailing commissions, management fees and other expenses all may be associated with investing in any of the Venator Alternative Mutual Funds. Please read the prospectus and Fund Facts relating to each Alternative Mutual Fund before investing. The indicated rates of return of the Venator Alternative Mutual Funds are the historical annual compounded total returns, including changes in share or unit value and the reinvestment of all dividends or distributions, and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any securityholder that would have reduced returns. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated.

The Venator Hedge Funds may only be purchased by accredited investors with a medium-to-high risk tolerance seeking long-term capital gains. Please read the Offering Memorandum for each Hedge Fund in full before making any investment decisions. Prospective investors should inform themselves as to the legal requirements for the purchase of securities. All stated Venator Hedge Fund returns are net of fees. It is important to note that past performance should not be taken as an indicator of future performance.

Commissions, trailing commissions, management fees and other expenses all may be associated with investing in any of the Venator Alternative Mutual Funds. Please read the prospectus and Fund Facts relating to each Alternative Mutual Fund before investing. The indicated rates of return of the Venator Alternative Mutual Funds are the historical annual compounded total returns, including changes in share or unit value and the reinvestment of all dividends or distributions, and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any securityholder that would have reduced returns. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated.

LEGAL DISCLAIMER