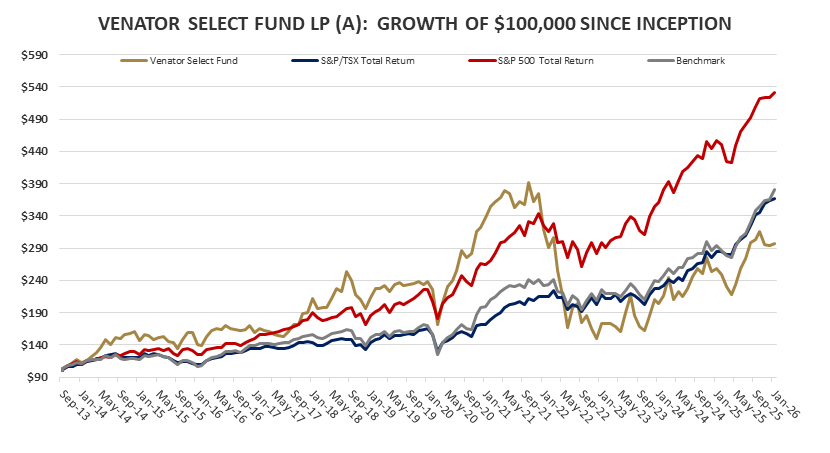

VENATOR SELECT FUND is a ‘best ideas’ strategy that strives to generate superior returns by concentrating investments in a small number of opportunities. The Fund can take both long & short investment positions in equity, debt, and derivative securities; as well as strategic trading in special situations. The allocation of long & short positions will vary depending on the opportunities that the Manager believes offer the best reward per unit of risk.

Investment restrictions are minimal with this strategy, and investors are encouraged to refer to the Offering Memorandum for more details relating to investment objectives, strategies, and restrictions.

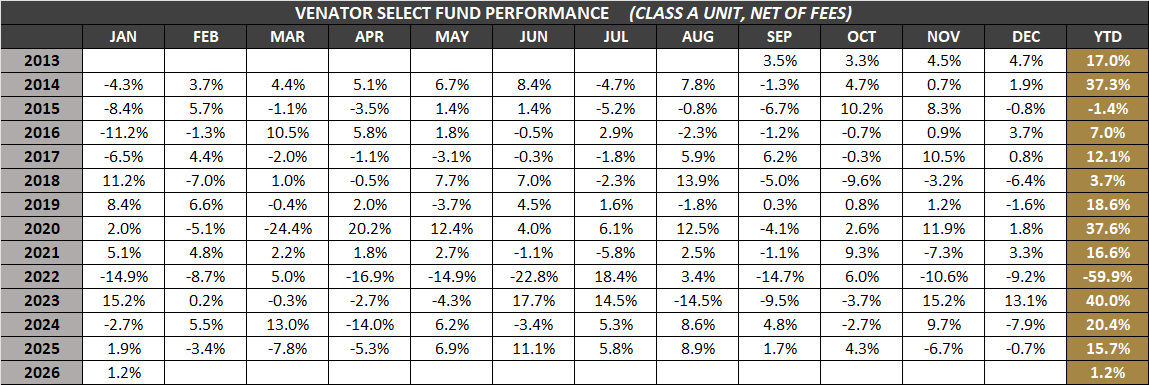

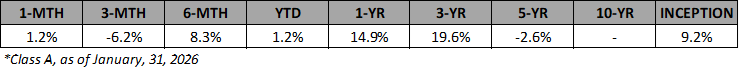

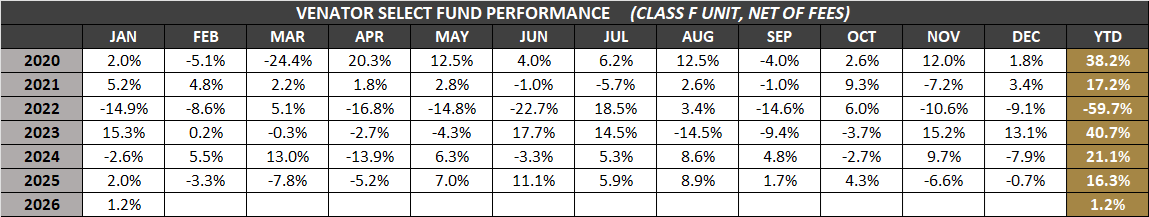

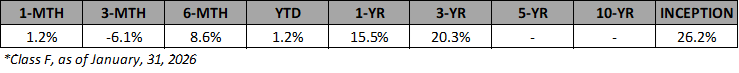

The Venator Hedge Funds may only be purchased by accredited investors with a medium-to-high risk tolerance seeking long-term capital gains. Please read the Offering Memorandum for each Hedge Fund in full before making any investment decisions. Prospective investors should inform themselves as to the legal requirements for the purchase of securities. All stated Venator Hedge Fund returns are net of fees. It is important to note that past performance should not be taken as an indicator of future performance.

Commissions, trailing commissions, management fees and other expenses all may be associated with investing in any of the Venator Alternative Mutual Funds. Please read the prospectus and Fund Facts relating to each Alternative Mutual Fund before investing. The indicated rates of return of the Venator Alternative Mutual Funds are the historical annual compounded total returns, including changes in share or unit value and the reinvestment of all dividends or distributions, and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any securityholder that would have reduced returns. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated.