VENATOR INCOME FUND is a long-bias North American yield strategy that strives to generate a 5%-10% annualized return over time, with relatively low volatility. The Fund invests in listed securities that generate income such as short duration corporate bonds, dividend equities, convertible bonds, and preferred shares. The Fund seeks to invest in quality businesses that can provide stable cash flows, while at the same time offering the potential for modest capital appreciation.

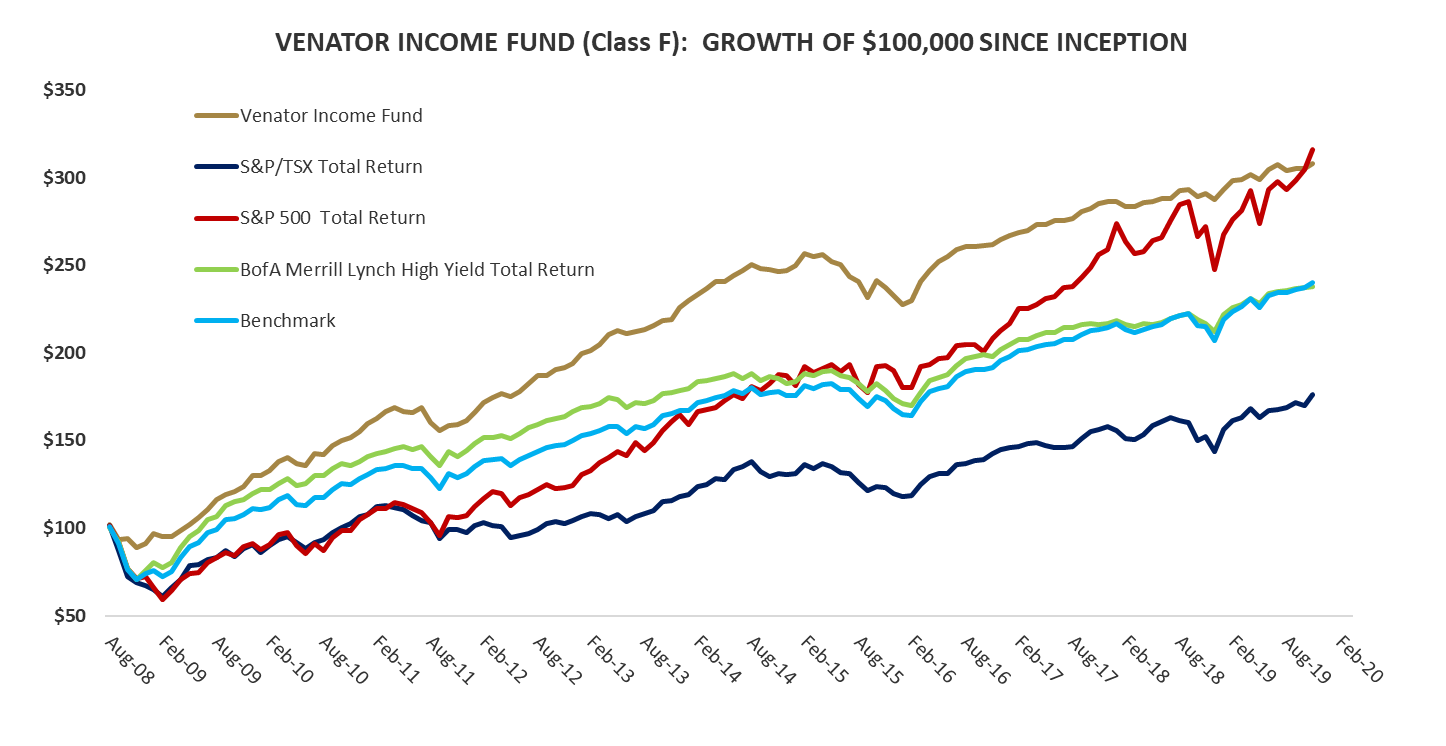

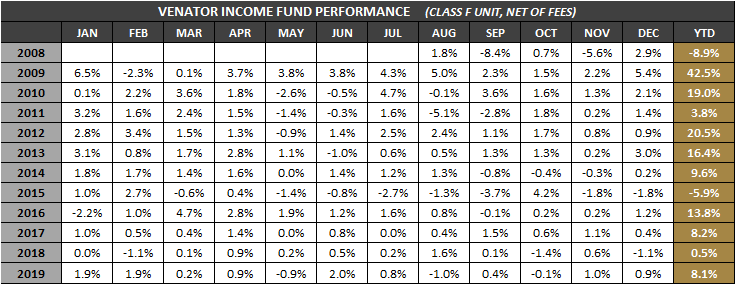

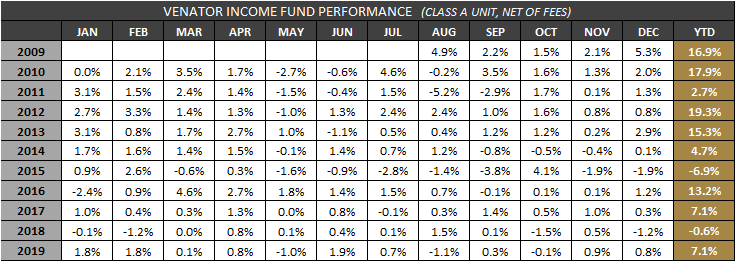

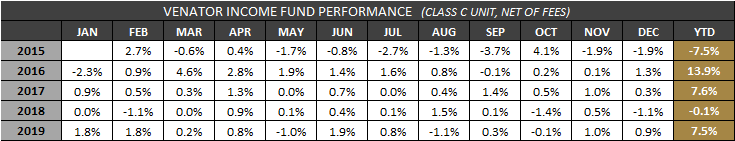

Please Note: Fund performance data is net of fees, however, it is not indicative of future performance, and should not be relied upon when evaluating the merits of a potential investment in the Fund. Performance data relating to market indices such as the S&P/TSX total return, the S&P 500 total return, the Russell 2000, the S&P Toronto Small Cap index, and the Merrill Lynch high yield index have been provided for information purposes only. A comparison of Fund performance to said indices is of limited use due to factors such as portfolio concentration and the potential use of leverage in the Fund.

INVESTMENT PHILOSOPHY

To achieve its 5%-10% annualized return target, the Fund will invest primarily in North American-listed securities that are expected to generate income such as short duration corporate bonds, dividend equities, convertible bonds, and preferred shares. Generally speaking, the Fund will look to invest in stocks & corporate bonds that can provide stable cash flows, and modest capital appreciation.

The Fund will concentrate its long positions in the following areas:

Corporate debt securities of non-cyclical businesses that generate consistent financial results and sustainable free cash flow; and where a strong likelihood of capital repayment exists. Debt securities with current yields of at least 4%, and yield to maturities of at least 7% will be targeted.

Dividend equities with consistent/predictable financial results, sustainable free cash flow, and yields exceeding 4%.

Convertible bonds with current yields exceeding 2%, and where conversion to equity appears likely; or where yields to maturity exceed 7% if conversion to equity appears unlikely.

Preferred shares with yields exceeding 4%.

Venator Capital Management Ltd. applies its proprietary screening process to help Venator Income Fund ‘hunt’ for attractive investment opportunities across North America. As always, Venator Capital Management Ltd. follows up its initial screening process with its own research and due diligence to separate the truly quality investments from those that simply look good on the surface.

RISK TOLERANCE / RISK MANAGEMENT / HEDGING

Investors considering an investment in Venator Income Fund should have a medium risk tolerance, and at least a 5-year time horizon.

Venator Income Fund does not use excessive leverage as part of its investment strategy. Although leverage may potentially enhance returns, it also increases risk – which is a characteristic that the Fund seeks to avoid.

Gross exposure has typically been in the 120%-130% range; while net exposure has typically been 90%+. Please note, however, that the Fund may attempt to periodically hedge against market risk through the short selling of market index tracking instruments.

Venator Income Fund is currency neutral, having hedged out its US dollar denominated exposure.

SUMMARY OF TERMS

| Structure: | Investment Trust |

|---|---|

| Management Fee: | 2% (Class A); 1.5% (Class C); 1% (Class F) |

| Performance Fee: | 10%; with a 5% threshold; and a perpetual high water mark |

| Minimum Investment: | $50,000 |

| FundSERV Codes: | VCM 200 (Class A); VCM 210 (Class F); VCM 250 (Class C) |

| Liquidity: | Month-End |

| RSP Eligible: | Yes |

Please note: Fund redemptions require 45 days notice; and redemption proceeds typically settle within 10 business days following the redemption date.

LEGAL DISCLAIMER